In the investment world, achieving both financial gains and positive social impact is a powerful goal. The Qualified Opportunity Zone (QOZ investing) program makes this possible by offering significant tax benefits while driving economic growth in underserved communities.

This article explores the tax advantages, community impact, and key considerations to help you navigate QOZ investing.

Unlock Tax Advantages Through QOZ Investing

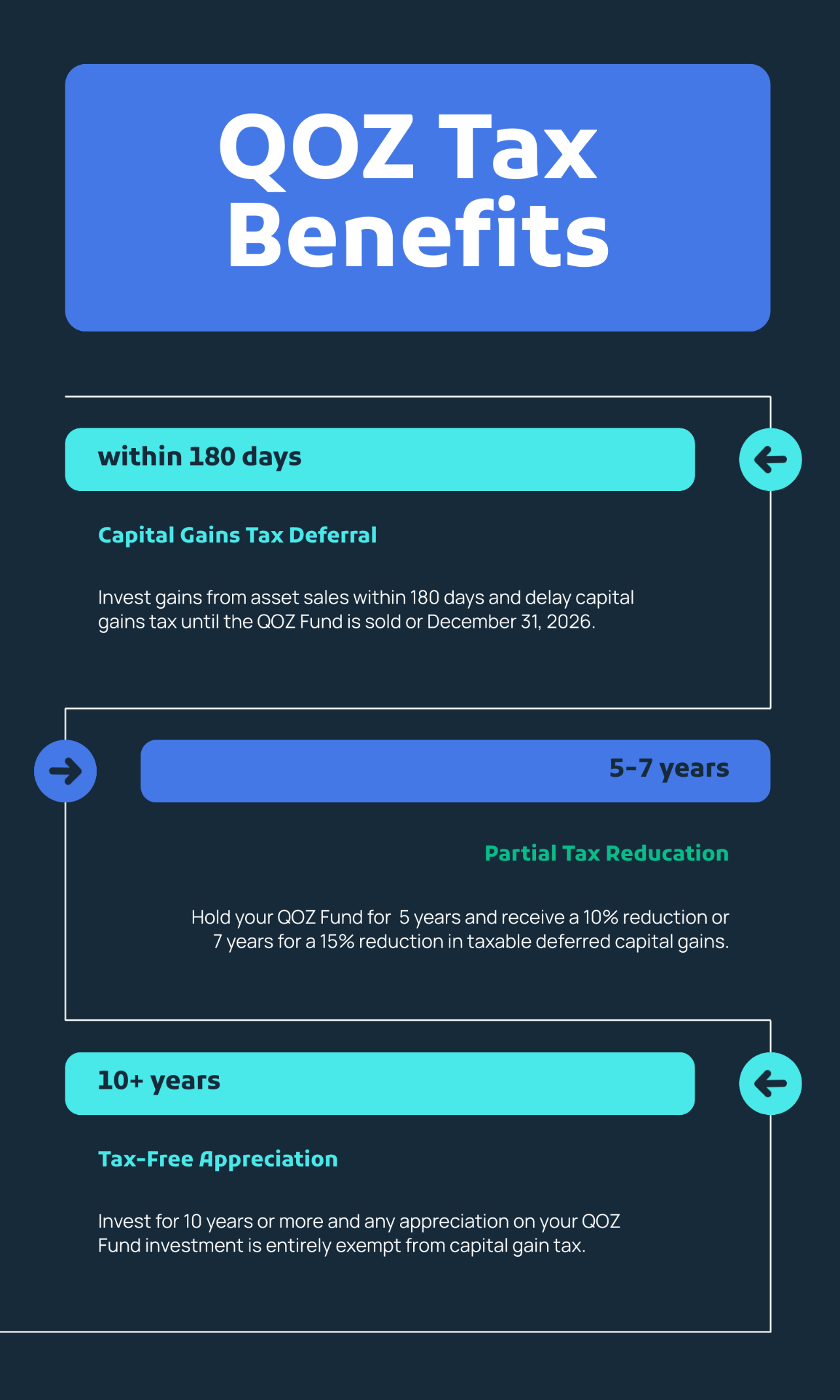

The Qualified Opportunity Zone program encourages long-term investment in designated low-income areas by providing a triple tax advantage:

1. Capital Gains Tax Deferral

Reinvest capital gains from asset sales into a Qualified Opportunity Fund (QOZ Fund) within 180 days and delay capital gains tax until the QOZ Fund is sold or December 31, 2026, whichever comes first.

2. Partial Capital Gains Tax Reduction

You can benefit from 10-15% tax savings through QOZ investing. Hold your QOZ Fund for five years to receive a 10% reduction in taxable deferred capital gains. Extend the holding period to seven years to enjoy a 15% reduction.

3. Tax-Free Appreciation

Long-term tax incentives fully take effect with a capital gains tax exemption after a 10-year holding period. If you can stay invested for a decade, any appreciation on your QOZ Fund investment is entirely exempt, offering substantial tax savings.

QOZ investing, a form of intentional tax planning and preparation, is an attractive strategy for investors seeking to optimize their portfolios while minimizing tax liabilities.

Driving Positive Community Impact and Revitalization

Beyond tax benefits, the Qualified Opportunity Zone program empowers economically distressed communities. By channelling capital into QOZ Funds, investors support:

- Development of new businesses

- Job creation

- Infrastructure revitalization

- Increased economic activity

These efforts create a ripple effect, fostering community revitalization and improving the quality of life for residents and local businesses.

Navigating Qualified Opportunity Zone Complexities

While the tax advantages and social impact of QOZ investing are compelling, success requires careful planning. Consider these critical factors:

1. Compliance with IRS Regulations

Qualified Opportunity Zone Funds and their investments must meet strict IRS requirements. Partnering with program experts is essential to ensure you adhere to all specifications.

2. Staying Informed

The IRS frequently updates QOZ guidelines. A knowledgeable financial advisor can help you stay compliant and maximize tax benefits.

3. Strategic Investment

Choose a QOZ Fund with a proven track record and a clear investment strategy to align with your financial and community impact goals.

Why Choose Qualified Opportunity Zone Investing?

The Qualified Opportunity Zone program offers a unique blend of tax savings, portfolio diversification, and meaningful social impact. By leveraging tax incentives and supporting community revitalization, you can foster financial success and social good.

Ready to explore QOZ investing? Contact Superstein CPA to maximize your tax benefits and make a lasting impact.

Disclaimer: This blog contains general information and does not constitute the rendering of legal, accounting, investment, tax, or other professional services. Consult with your advisors regarding the applicability of this content to your specific circumstances.