Are you an investor in a small business with high growth potential? Understanding Qualified Small

Business Stock could transform your tax strategy. IRC Section 1202 provides significant incentives for

investors holding QSBS.

This guide explores QSBS tax benefits, eligibility, and strategies to optimize your investment.

What is Qualified Small Business Stock and How Does It Benefit Investors?

Qualified Small Business Stock refers to stock issued by a domestic C corporation that meets specific size and operational criteria. By holding QSBS for more than five years, eligible investors can exclude up to 100% of capital gains from taxable income upon selling the stock. Through tax preparation, this tax exclusion can significantly reduce your tax liability, making QSBS a compelling option for those investing in promising small businesses.

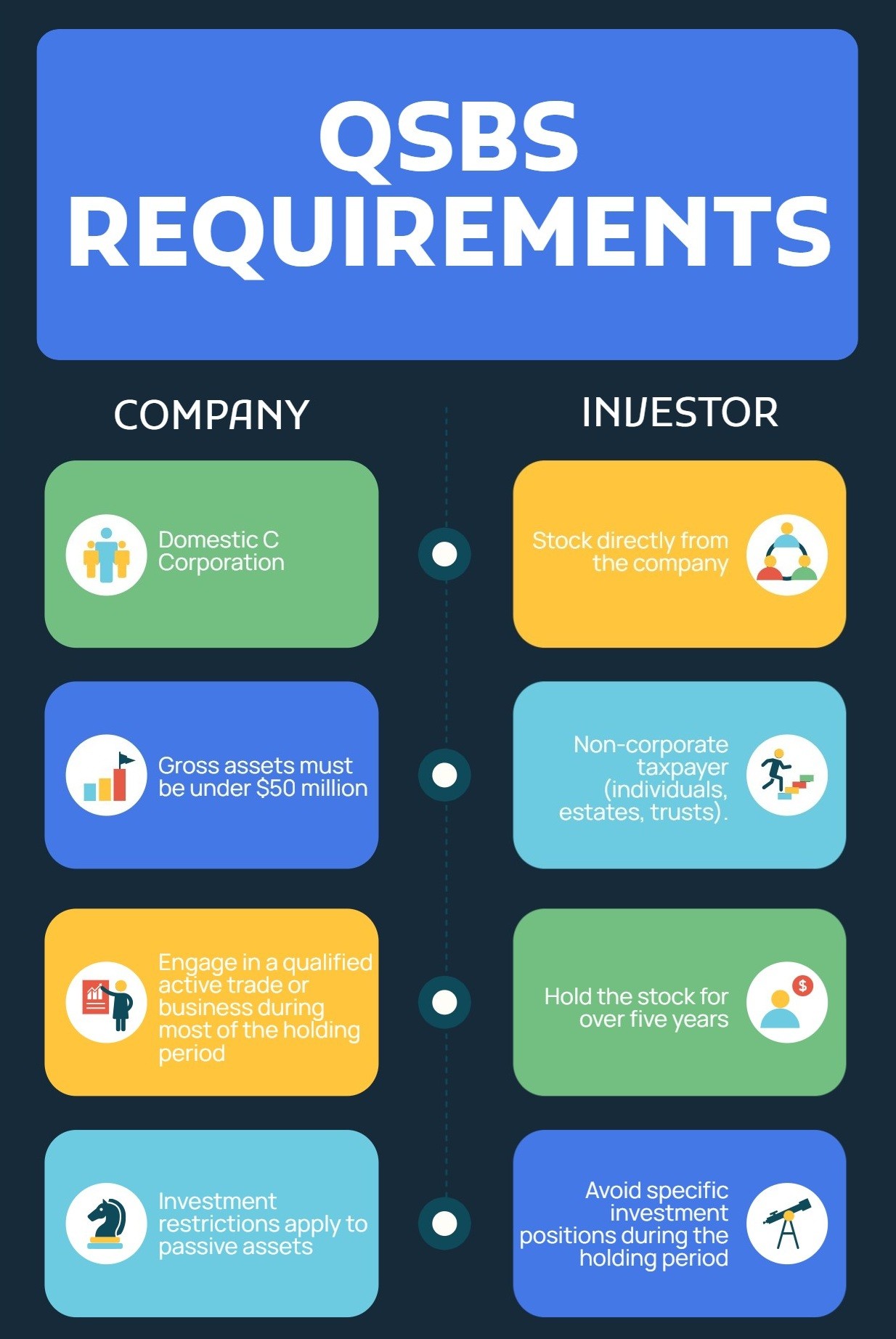

QSBS Tax Benefits: Company and Investor Requirements

To qualify for QSBS tax benefits, both the company and investor must meet strict requirements:

Company Requirements:

- Must be a domestic C corporation.

- Gross assets must be under $50 million before and after stock issuance.

- Must engage in a qualified active trade or business during most of the holding period.

- Investment restrictions apply to certain passive assets.

Investor Requirements:

- Acquire the stock directly from the company (via cash, property, or services).

- Be a non-corporate taxpayer (individuals, estates, trusts).

- Hold the stock for over five years.

- Avoid specific investment positions during the holding period.

Exclusion Caps on QSBS Tax Benefits

IRC Section 1202 offers two exclusion caps on Qualified Small Business Stock tax savings:

- $10 million exclusion cap: This cap applies to the total QSBS gains excluded for all taxpayers selling stock from the same company.

- 10x basis exclusion cap: This cap is based on your original investment in the QSBS.

Strategic planning, such as “stacking” and “packing” techniques, can help maximize your QSBS tax benefits. Consider consulting a tax professional to tailor a strategy to your portfolio and leverage these caps effectively.

The QSBS Issuance Date Impacts Tax Exclusion

The acquisition date of your QSBS affects the tax exclusion percentage:

- Stock acquired after September 27, 2010, qualifies for a 100% exclusion.

- Earlier acquisitions may qualify for 50% or 75% exclusions.

Maximize QSBS Tax Savings with Structured Stock Sales

To claim the QSBS tax exclusion and benefits, structure the sale as a stock sale. While buyers might prefer asset acquisitions, alternatives like Section 351 exchanges or Section 368 reorganizations could preserve QSBS eligibility while meeting buyer needs. A tax professional can guide you through these structures to ensure compliance and maximize savings.

Ready to Reap the Reward of QSBS Tax Benefits?

Qualified Small Business Stock offers a powerful tax incentive for investors in eligible small businesses. By meeting the requirements and planning strategically, you can significantly reduce your tax burden and unlock the full potential of your investment returns.

Interested in partnering with a tax professional to maximize your savings? Contact Superstein PA to navigate the complexities of IRC Section 1202 and fully leverage your QSBS tax benefits.

Disclaimer: This blog contains general information and does not constitute the rendering of legal, accounting, investment, tax, or other professional services. Consult with your advisors regarding the applicability of this content to your specific circumstances.